On Tuesday, Micron Technology Inc (NASDAQ:MU) announced the release of a new category of clock driver memory modules aimed at next-generation PCs, including AI-driven systems.

The company unveiled its Crucial DDR5 clocked unbuffered dual inline memory modules (CUDIMM) and clocked small outline dual memory modules (CSODIMM), now shipping in volume.

Based on JEDEC standards, these modules offer speeds up to 6,400 MT/s, over twice the speed of DDR4 and 15% faster than non-clock-driver-based DDR5 solutions.

Also Read: Microsoft’s AI PCs Stumble With Game Compatibility: Report

The newly launched memory modules bring enhanced speed stability, faster downloads, and improved refresh rates, which are crucial for demanding workloads. Intel Corp (NASDAQ:INTC) validated these solutions for its latest Intel Core Ultra processors, so the memory can scale up to 64GB, empowering high-performance PCs and AI workstations.

Dinesh Bahal, corporate vice president of Micron’s Commercial Products Group, said, “Micron is shipping the industry’s first JEDEC-standard DDR5 CUDIMM and CSODIMM solutions to power fast, out-of-the-box speeds for AI PCs and high-end workstations.”

Dimitrios Ziakas, vice president of memory and I/O technologies at Intel, noted, “The combination of Intel Core Ultra desktop processors and Micron’s clock driver-powered memory will propel AI PCs to new heights, delivering 6,400 MT/s speeds.”

Micron’s new offerings are suited for desktop and laptop systems, available from 16GB to 64 GB.

According to Canalys, AI PC shipments reached 8.8 million in the second quarter of 2024, accounting for 14% of total PCs. Apple led the AI-capable PC market with its entire Mac lineup, followed by Intel, Advanced Micro Devices, Inc. (NASDAQ:AMD), and Qualcomm Inc. (NASDAQ:QCOM).

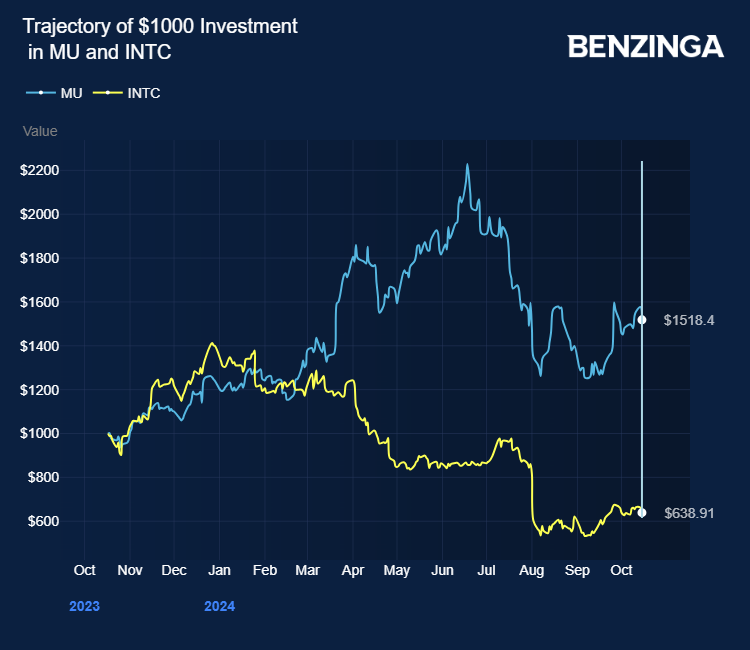

Micron Technology stock gained over 51% in the last 12 months.

Cantor Fitzgerald analyst C J Muse cited the upside from Micron’s high-margin products and AI-driven data center demand.

However, Muse and KeyBanc analyst John Vinh highlighted oversupply concerns as US sanctions on China prompted Samsung to convert its unused HBM capacity back to traditional DRAM to survive the competition.

Price Action: MU stock is up 0.70% at $105.05 premarket at last check Wednesday.

Also Read:

Photo: courtesy of Micron